[ad_1]

Bitcoin has outpaced Ethereum in daily transaction fees, signaling heightened investor interest in the leading cryptocurrency.

CryptoFees data shows that Bitcoin’s daily fees averaged $10.65 million from November 16 to November 18, surpassing Ethereum’s average fee of $6.9 million for the same period.

BTC Transaction Fees Surge

Bitcoin’s average transaction fees have notably risen since the start of this month, escalating over 1,000% to a peak of $18.67 on November 16, as per BitInfoCharts data.

This surge reflects the market’s growing optimism regarding the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the US. However, the Securities and Exchange Commission (SEC) remains hesitant, delaying decisions on various Bitcoin ETF applications until 2024.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Market analysts also attribute BTC’s transaction fees spike to the revival of Ordinal Inscriptions. These digital assets, akin to NFTs but on BTC’s smallest denomination, satoshis, gained traction earlier this year, signaling Bitcoin’s venture into the NFT sector.

While interest waned as the market evolved, a resurgence occurred as these assets expanded to other blockchain networks like Polygon and Litecoin.

Bitcoin Increasing Adoption

Despite concerns that high transaction fees might deter BTC users, on-chain data indicates the opposite trend.

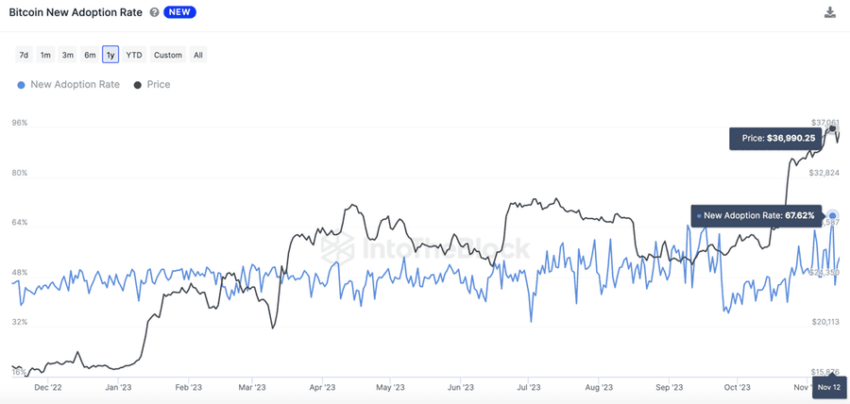

IntoTheBlock reports a new yearly high in Bitcoin adoption, reaching 67.62% this week. This uptick signifies a rise in newly created active addresses, indicating an influx of new market participants. Furthermore, the volume of BTC held by long-term investors hit an all-time high, with over 1 million addresses owning more than 1 unit of Bitcoin.

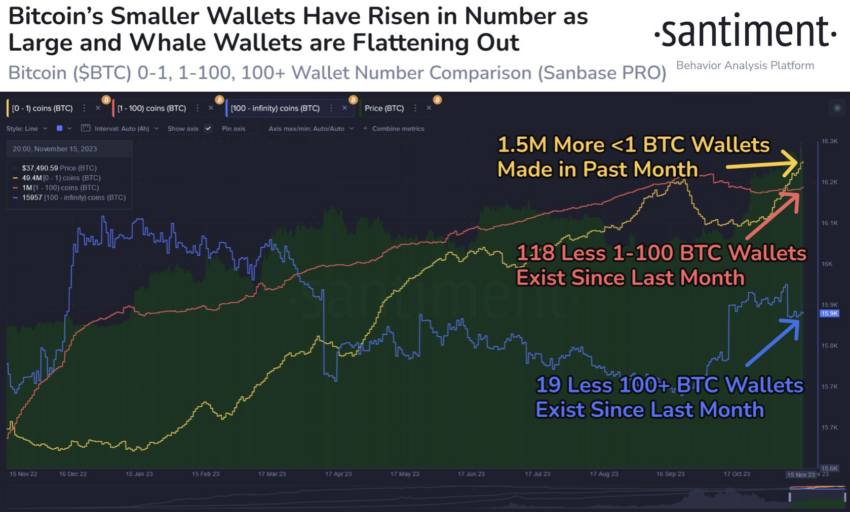

Blockchain analytics firm Santiment also reinforces these findings, noting an increase in smaller wallets with less than 1 BTC.

“Bitcoin’s wallets have fluctuated during this major market-wide surge. Tons of new smaller wallets with less than 1 BTC have flooded the network. Meanwhile, the 1-100 tier has flattened out, and the 100+ tier may be in the midst of some profit-taking,” Santiment affirmed.

Strike CEO Jack Mallers has also expressed bullish sentiments, foreseeing the price of Bitcoin reaching “hundreds of thousands of dollars.” He emphasized that Bitcoin’s price growth is fueled by innovative technology and its status as superior money.

“Bitcoin’s price equals technology plus fiat liqudity. So, it is going to go up because it is innovative tech and better money but what would really shoot it up at a neck-breaking pace is when our government has tens of trillions in debt and has to roll that over by printing a lot of money… Bitcoin goes up the most because it is the hardest to make more of,” Mallers said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link

Be the first to comment