[ad_1]

New research suggests that Solana has emerged as a standout. It draws comparisons to tech giant Apple, especially for its innovative approach to melding hardware and software.

However, the allure of Solana extends beyond just another Apple mimic. Unlike Apple’s hardware-centric approach, Solana inverts the equation, focusing on leveraging hardware to enhance and broaden the Web3 experience.

How Solana Stands Out in the Crypto Market

Co-founder Raj Gokal often articulates Solana’s vision as the “Apple of crypto.” It highlights the ambition to innovate through software, introducing new functionalities and experiences rather than only facilitating hardware sales.

This analogy, while apt in showcasing Solana’s dedication to performance and user experience (UX), only scratches the surface. According to researchers at Four Pillars, the true essence of Solana lies in its network performance, which is powered by multi-threading for parallel processing.

This technical prowess has attracted a pragmatic developers keen to explore Solana’s potential during the DeFi and NFT boom. Its ability to offer fast transactions at low fees quickly positioned it as a competitor to Ethereum.

“Solana is capable of processing thousands of transactions per second, with block times recorded at 400-500ms — significantly higher performance than existing blockchains. Ultimately, Solana’s adoption of this technical approach aims to achieve two missions: an expandable platform that can handle high usage and composability between applications,” researchers at Four Pillars wrote.

The commitment of those who shared Solana’s vision has not wavered. Indeed, the focus on bolstering network stability and tackling technical challenges has helped foster the community’s confidence.

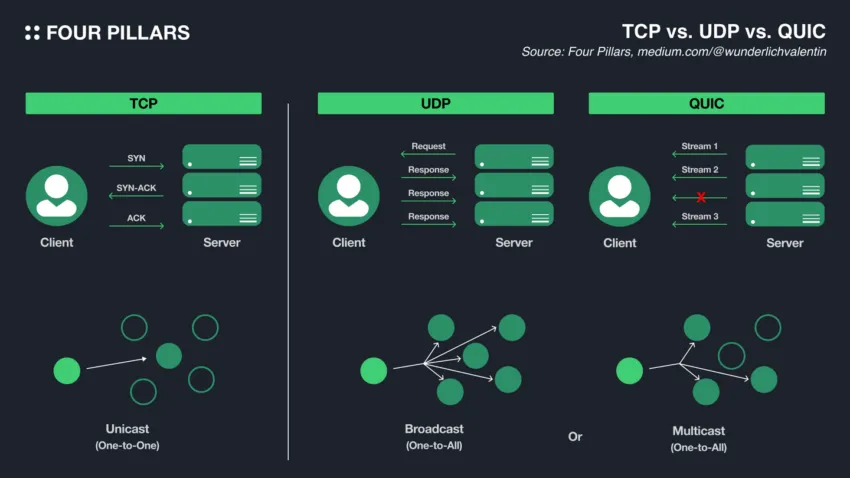

Solana addressed its network vulnerabilities, adopting the QUIC protocol for reliable communication and introducing Staked-Weighted Quality of Service (QoS) to prioritize traffic based on SOL stakes. Additionally, introducing a Localized Fee Market helped mitigate spam and encouraged efficient network usage.

“QUIC is a new communication protocol based on UDP, maintaining its advantages while simplifying TCP’s connection streams and handshake processes. Thus, QUIC allows Solana to achieve reliable communication, request retransmission only for streams with packet loss, and continue transmitting the rest without interruption, significantly enhancing network efficiency,” researchers at Four Pillars added.

Read more: 13 Best Solana (SOL) Wallets To Consider In March 2024

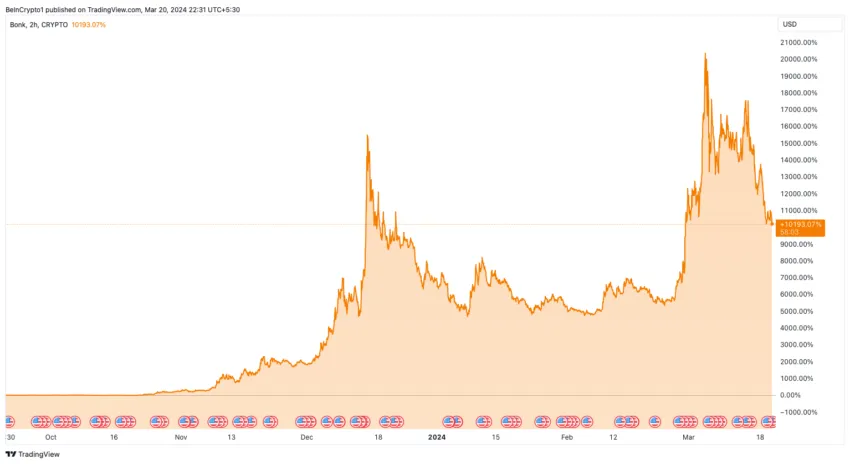

Central to Solana’s ethos is the community and ecosystem development. Initiatives like the BONK meme coin airdrop galvanized the Solana community by allocating 5% of its total supply to developers. This distribution unified the community and sparked significant growth within the ecosystem as developers engaged in reconstruction efforts.

Remarkably, the meme coin’s value surged by 20,400% from its lowest point, creating a positive feedback loop that renewed interest in Solana. This upswing led to the distribution of 30 million BONK tokens to users of the Saga mobile device. This further amplifyied interest in both BONK and Solana.

Additionally, various platforms within the ecosystem, such as Jito, Pyth Network, and Jupiter, announced their own airdrop strategies, further invigorating market enthusiasm. Other entities in the ecosystem like Tensor, marginfi, Zeta, and Parcl revealed plans for airdrop-related incentives as well.

Solana’s strategic initiatives have extended beyond technical enhancements and airdrops. By pioneering in areas such as decentralized physical infrastructure network (DePIN) and seamless crypto asset payments, Solana is actively bridging the gap between blockchain and traditional financial systems. Partnerships with industry giants like Circle and Visa reflect an authoritative stance in the crypto payments space.

Moreover, Solana’s commitment to diversity in validator clients and decentralization speaks to its dedication to network stability and security. Initiatives aimed at reducing the operational costs of running a node and increasing the Nakamoto Coefficient reflect Solana’s nuanced approach to scalability and decentralization.

Such developments have attracted institutional interest, as evidenced by positive remarks from Ark Invest’s CEO, Cathie Wood.

“Solana is doing a really good job. If you look at Ethereum it was faster and cheaper than Bitcoin in the day. Solana is faster and more cost-effective than Ethereum,” Wood said.

Read more: Solana (SOL) Price Prediction 2024 / 2025 / 2030

As Solana continues to expand its business outreach and solidify its internal foundation, it cements its position as a leader in the crypto market, reminiscent of Apple’s influence in technology.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link

Be the first to comment