[ad_1]

BlackRock and Fidelity’s spot Bitcoin ETFs have an advantage over Grayscale’s GBTC in two key liquidity metrics, according to a new report by JP Morgan shared with Decrypt.

Although outflows from spot Bitcoin ETFs, and in particular GBTC, have slowed over the past two weeks, JP Morgan’s analysts concluded that over time Grayscale’s fund will likely lose further funds to BlackRock and Fidelity’s ETFs, absent “meaningful cuts to fees” for GBTC.

JP Morgan’s analysts attribute this to two key advantages for the Fidelity and BlackRock ETFs. The first is a proxy for market breadth based on the Hui-Heubel ratio, which is approximately four times lower for BlackRock and Fidelity’s ETFs than for GBTC, suggesting that they exhibit greater market breadth.

Generally speaking, market breadth is a measure used to gauge the overall direction of a market by comparing the number of companies whose stock prices are increasing to the number of companies whose stock prices are decreasing. It helps investors understand the extent of market movements and whether they are broadly supported by the performance of many companies or driven by just a few.

When it comes to ETFs, understanding the breadth of a market gives analysts a benchmark against when to emasure how well a fund tracks it.

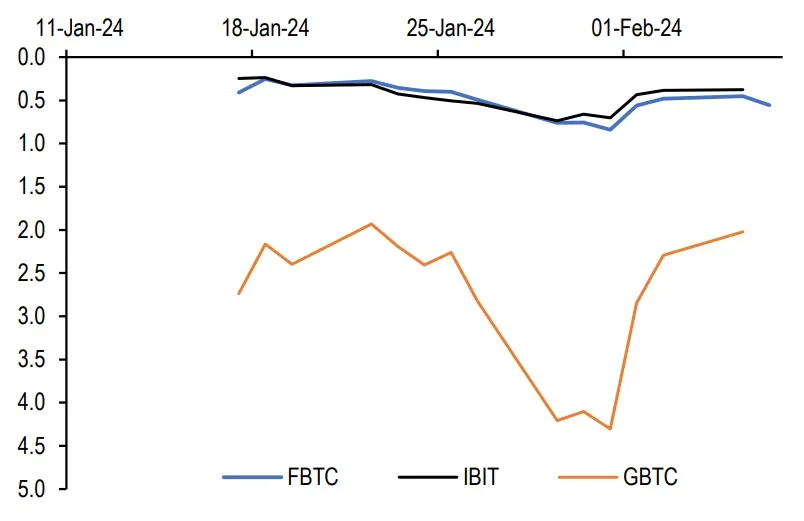

The second is based on the average absolute deviation of each ETF’s closing prices from net asset value (NAV). Over the past week, the analysts noted, this metric indicated that the ETF price deviation from NAV of BlackRock and Fidelity’s spot Bitcoin ETFs approached that of the GLD Gold ETF. This, they suggest, implies “a significant improvement in liquidity, while the deviations for the GBTC ETF have remained higher implying lower liquidity.”

Grayscale’s GBTC has seen significant outflows since its conversion into a spot Bitcoin ETF, following the SEC’s landmark approval of multiple spot Bitcoin ETFs last month.

Prior to its conversion to an ETF, investors holding GBTC shares were locked in for at least six months before they could sell them. With its conversion to an ETF, those investors have been taking the opportunity to cash out, causing huge sell-offs as they exit their positions.

Those sell-offs have, in turn, caused the price of Bitcoin to slump in the weeks following the ETFs’ approval, though there are signs the market slump may be easing off, with Bitcoin trading back at levels approaching $45,000 in the last day.

Edited by Stacy Elliott.

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link

Be the first to comment